FHA is the new subprime

Some astounding information is coming out regarding the deterioration of FHA insured loans:

“(Reuters)- Fitch Ratings sees a growing divergence between 90-day past due delinquency patterns for guaranteed and nonguaranteed loans as a potentially troubling signal of future losses. This may eventually force the FHA to look for opportunities to put back some defaulted loans to the banks, particularly if the agency’s funding status worsens and U.S. home prices fail to rebound quickly.”What stood out in the report is that eight of the largest US banks now have $79.4 billion in delinquent FHA insured loans. Of this, 83 percent represent government-guaranteed mortgages. If you need additional proof of this maximum leverage nonsense and that banks are willing to give loans out to a homeless person if they could offload the risk to the American taxpayer, read this:

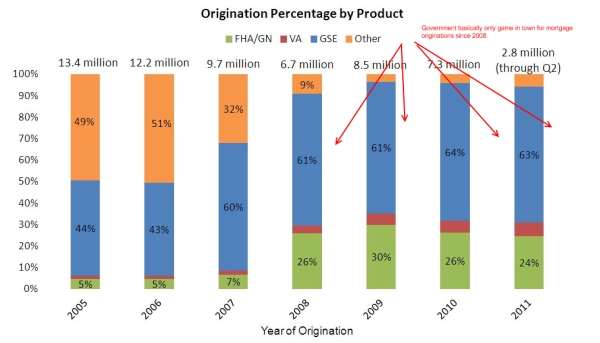

“While delinquency rates for nonguaranteed loans have been improving steadily at these institutions, the trend for FHA-guaranteed loans is starkly different.”In other words, banks are cautious when their money is at stake but when it comes to government backed loans they are willing to make any kind of loan product so long as they get their cut. This is very similar to the entire Alt-A MBS process where banks bundled crap loans together and distributed their toxic waste around the globe deceiving investors. Now why is this a problem? Because FHA has essentially stepped in as the low-rung mortgage option:

Source: http://www.doctorhousingbubble.com/

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.